Key Takeaways

- Choose cryptocurrencies with sufficient liquidity (ideally $50+ million daily volume for major coins) to ensure quick entries and exits without price slippage.

- Focus on coins with moderate volatility (5-15% daily price fluctuations) to balance profit potential against excessive risk.

- Utilise technical indicators like moving averages (SMAs/EMAs), RSI, and volume-based tools (OBV, VWAP) to identify short-term trading opportunities

- Implement strict risk management by setting appropriate stop-losses and limiting position sizes to 1-2% of your trading capital per trade.

- Conduct thorough backtesting and paper trading before committing real funds to verify your strategy’s effectiveness.

- Monitor market sentiment through specialised tools like LunarCrush and the Fear and Greed Index to anticipate potential price movements.

I’ve been day trading cryptocurrencies for years, and let me tell you this: choosing the right crypto coins will absolutely be the difference between profitable day trades and costly mistakes. The volatility of cryptocurrency creates excellent conditions for day trading, but you have to target the right crypto assets and follow your trading strategies correctly.

In my experience, successful crypto day trading isn’t about chasing the newest tokens or following social media hype. It’s about systematic selection based on liquidity, volatility patterns, and technical indicators that signal potential short-term movements. I’ve developed a framework that’s helped me identify promising trading opportunities while managing risk effectively.

Understanding the Basics of Cryptocurrency Day Trading

Day trading cryptocurrencies requires a fundamental understanding of how these digital markets function and what sets them apart from traditional trading environments.

What Makes Crypto Day Trading Different

Cryptocurrency day trading operates in a 24/7 market, unlike traditional exchanges with fixed hours. This round-the-clock accessibility means I can trade at any time, capitalising on global price movements without restrictions. Crypto markets also exhibit higher volatility, with price swings of 5-10% in a single day being common for major coins like Bitcoin and Ethereum.

The barrier to entry is significantly lower, too. I started with just £100, whereas stock trading often requires substantial capital. Transaction speeds are remarkably faster in crypto, with trades settling in minutes rather than days. Also, it is important to consider that the majority of the crypto market is not regulated like the normal markets, so you have that freedom, but also very little protection from losing some or all of your funds.

Essential Terminology for Beginners in Crypto Day Trading

Understanding key terms has been crucial to my trading success. Order books are where buy and sell orders for a cryptocurrency are displayed, called an order book. When a trader buys and sells crypto in real time, it shows the order book market depth for that particular cryptocurrency. Limit orders allow me to set specific prices at which to buy or sell, and market orders execute my buy or sell order at the market price available in real time.

A liquidation is when my leveraged position is automatically closed because the price of the cryptocurrency moved against my position beyond my equity margin. I’ve learned to monitor support and resistance levels—price points where assets historically struggle to move beyond. The candle patterns on the price charts allow me to identify potential reversal or continuation patterns.

With regards to definitions of terminology specific to cryptocurrency, gas fees are the transaction costs for using networks like Ethereum, block time is the time for confirmation after the transaction, and market cap is the total amount of value of the circulating supply of a coin. Understanding these terminology definitions has significantly advanced my analysis & decision-making capabilities as a Crypto Day Trader.

Researching Market Capitalisation and Trading Volume

Why Market Cap Matters for Day Traders

Market capitalization is a metric that provides insights into a cryptocurrency’s stability and price movement behavior. The higher the market cap of the cryptocurrency, as I’ve learned from watching Bitcoin and Ethereum, the less volatility is provided by trading. These established coins inspire greater market trust and tend to have more consistent price movements that follow identifiable patterns.

Mid and small-cap cryptocurrencies present different trading opportunities with potentially higher percentage gains in shorter timeframes. However, they come with increased risk profiles. From my trading experience, balancing my portfolio between different market cap segments helps optimise both security and profit potential for day trading activities.

How to Identify Suitable Trading Volumes

Volume is a metric that measures overall liquidity and ultimately tells you whether you can get a trade executed. I look for cryptocurrencies with consistently high 24-hour volume on multiple exchanges. This means I can get in and out of trades quickly without poor execution.

For trading to sustain itself, I prefer the volume of daily trading for large coins to be over $50 million and $10 million for altcoins. Viewing the volume trend, hourly, daily, and/or weekly, will ensure that specially picked coins provide enough volume to trade too, not just in the moment spiking volume.

Expert trader Michael van de Poppe emphasises: “Volume precedes price. Look for increasing volume as confirmation of emerging trends before entering positions.” I’ve applied this principle successfully by targeting coins where growing volume accompanies price breakouts, substantially improving my trade timing and profitability.

Understanding Patterns of Trends in Volatility

The volatility has both huge profit potential and risks associated with day-trading cryptocurrencies. In order to continue to trade successfully in this space, it is essential to know these trends and coin patterns. Don’t be surprised!

How to Measure Volatility

Historical volatility (HV) serves as my primary metric when evaluating cryptocurrencies for day trading. I calculate this as the standard deviation of price returns over specific periods, typically 14-30 days. The Average True Range (ATR) indicator has proven invaluable for quantifying price movements in absolute terms. Bollinger Bands provide visual confirmation of volatility trends on my charts. When these bands widen, I prepare for potential breakouts that often create profitable entry points. I’ve found that combining these three measurement tools gives me a comprehensive volatility profile for any cryptocurrency.

Finding the Sweet Spot Between Risk and Opportunity

The ‘most favorable volatility’ is subjective, based on your risk tolerance and trading strategy. I try to focus on coins with a daily price range of 5-15%. With this volatility, there are enough expectations for profitability, without an overwhelming amount of risk. Keep in mind that market dynamics, i.e., retail sentiment, regulatory news, or low liquidity, have the potential to take volatility in unpredictable directions. I found the best trading results reinforced in mildly volatile markets, where price movement continued to provide a defined and calculable path to make technical decisions. While there is a cliche tied to cryptocurrencies from trader Mike Novogratz, “Volatility is opportunity, but only if you have the discipline to manage risk.” The manageability of that risk is adjusted every day based on market conditions.

Evaluating Technical Indicators for Short-Term Moves

Moving Averages and Momentum Indicators

Moving averages are my main tools for working through crypto trading opportunities. I primarily use Simple Moving Averages (SMAs) to map the overall market’s upward trend over an average price for a given time. I also incorporate Exponential Moving Averages (EMAs) to consider price action in a more aggressive timeline.

The crossover of a shorter moving average over a longer moving average can provide early entry signals. We commonly see this with the 20-day EMA intersecting the 50-day EMA, indicative of a move to the upside. Using momentum indicators like the Relative Strength Index (RSI) is also useful in trying to gauge overbought and oversold price ranges.

My most profitable trades occurred when combining these indicators rather than relying on a single metric. As trader Michael van de Poppe notes, “The confluence of multiple indicators provides stronger signals than any individual tool alone.”

Volume-Based Indicators for Day Trading

Volume analysis forms the backbone of my crypto day trading strategy. On-Balance Volume (OBV) helps me confirm price movements by tracking cumulative buying and selling pressure. When price increases align with rising OBV, the uptrend typically has stronger validity.

The Volume Weighted Average Price (VWAP) has been very useful for intraday decisions. The VWAP is the average price (weighted by volume) throughout the trading day. Trading above the VWAP overall means bulls are in control, and trading below the VWAP means bear pressure is on the market.

The Chaikin Money Flow (CMF) completely transformed my ability to analyze buying and selling pressure. The CMF gives me the opportunity to take advantage of reversals before they happen. Expert trader Josh Rager emphasises that “volume precedes price action in crypto markets,” a principle that’s significantly improved my trade timing and accuracy.

Assessing Liquidity and Exchange Support

Importance of Liquidity for Quick Entries and Exits

Liquidity is the most critical factor when it comes to successfully day trading in the crypto markets. I find that on the whole, trading well-known crypto assets like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB) is much more effective. These names have deep order books with a larger volume of trading activity, allowing traders to quickly enter and exit a transaction without slippage in price.

When I execute rapid scalping strategies, I rely exclusively on high-liquidity pairs. This has assisted me more times than I can account for when the markets totally reverse. As a professional trader once said to me, “High liquidity means trading can easily buy and sell assets with little to no slippage in price”, and that is paramount to making profits day trading.

Choosing Exchanges with Reliable Trading Features

When selecting my exchanges, I am interested in volume traded, security features, and trading tools. Exchanges like Binance, Coinbase Pro, and Kraken offer advanced charting options and large pools of liquidity to use for trading. The order execution speed directly impacts my profitability during volatile market conditions.

Monitoring Sentiment in News and Social Media

Market sentiment is a key price driver in cryptocurrency, so being aware of what is currently being said across news sources and social media can be beneficial. I find that knowing how traders and investors are feeling (as in the collective trader/investor mood) can provide a distinct advantage when making day trading decisions.

Using Sentiment Analysis Tools

Several specialised tools have transformed how I monitor crypto market sentiment. LunarCrush allows me to track social media mentions and engagement metrics to identify growing interest before price movements occur. CryptoMood uses AI to aggregate data from thousands of news sources and social media posts, and assigns sentiment scores to individual coins. I have also made the Fear and Greed Index another feature that I check daily, which, on a scale of extreme fear to extreme greed, measures the market’s emotions. These resources help me identify prospective trade opportunities when sentiment has shifted considerably in either direction.

Implementing Risk Management Strategies

Setting Appropriate Stop-Losses

Stop-losses are essential tools in my day trading arsenal. I will always set stop-losses ahead of entering any crypto position to limit my losses in the event that the market moves against my position. For a volatile cryptocurrency, my stop losses are generally placed between 5-10% below my entry, based on historical volatility patterns.

Technical analysis helps determine optimal stop-loss positions. I often place my stops just below key support levels or recent lows to avoid being caught in normal price fluctuations. This strategy has saved me countless times when crypto markets suddenly reversed direction.

Using trailing stop-losses for profitable trades has significantly improved my results. These automatically adjust upward as the price rises, locking in profits while still allowing room for further gains.

Position Sizing for Crypto Day Trading

Position sizing directly impacts my trading risk profile. I never risk more than 1-2% of my total trading capital on a single crypto trade, regardless of how “certain” the setup appears. This rule has protected my portfolio during unexpected market downturns.

For cryptocurrencies, the greater the volatility, the smaller my position size. You might be able to take larger position sizes on Bitcoin trades, due to the relatively small volatility. On the other hand, small-cap altcoins should naturally require you to take a smaller position to limit risk.

I calculate position sizes mathematically based on my stop-loss placement. If I’m willing to risk £100 on a trade with a 5% stop-loss, I determine my total position value accordingly. This systematic approach ensures I maintain consistent risk parameters across all my crypto day trades.

Developing and Testing Your Trading Strategy

Creating a Crypto Day Trading Plan

A good trading plan is fundamental to successful day trading in cryptocurrency. I have found that good plans almost always include specific entry and exit criteria relying on technical indicators such as moving averages and RSI. My plan gives precise information related to which cryptocurrencies I should be trading (mostly high liquidity cryptos, such as Bitcoin and Ethereum). I have daily profit goals and daily loss limits. I typically risk no more than 1-2% of my capital on one trade. Trading expert Josh Rager emphasises that “consistency comes from following a detailed plan, not from chasing emotions.” Time-specific strategies also matter; I’ve identified my most profitable trading windows between 8-10 am and 3-5 pm GMT when market volatility often peaks.

Backtesting and Paper Trading Techniques

Backtesting involves applying your strategy to historical data to evaluate its effectiveness before risking real capital. I use platforms like TradingView to backtest strategies against historical crypto price movements. This practice has helped me identify which technical indicators perform best across different market conditions. Paper trading follows backtesting as a risk-free simulation of real trading. I spent three months paper trading on Binance’s testnet before committing actual funds. Trader Michael van de Poppe recommends “at least 100 simulated trades before going live with any strategy.” My paper trading revealed that strategies performing well during sideways markets often failed during trending markets. This discovery prevented significant losses when I transitioned to live trading.

Using Specialised Tools for Crypto Selection

Finding the right cryptocurrencies for day trading requires powerful tools that help identify optimal trading candidates. I’ve discovered that specialised platforms and software dramatically improve selection accuracy and trading outcomes.

Crypto Screening Platforms

I rely heavily on crypto screening platforms to choose what to trade during the day. I primarily observe Bitcoin and Ethereum, as they are large and therefore tough to manipulate the market. When I look at a potential candidate, I focus on the amount of trading volume they do. I am able to buy and sell in large amounts without noticing big changes in the price of the asset. CoinMarketCap and CryptoCompare are useful for instantly filtering cryptocurrencies with the metrics I’m interested in, sparing me hours of looking up information myself. For me, taking into account how much $100 million in daily trading happens on any coin helps ensure I have the liquidity I require during day trading.

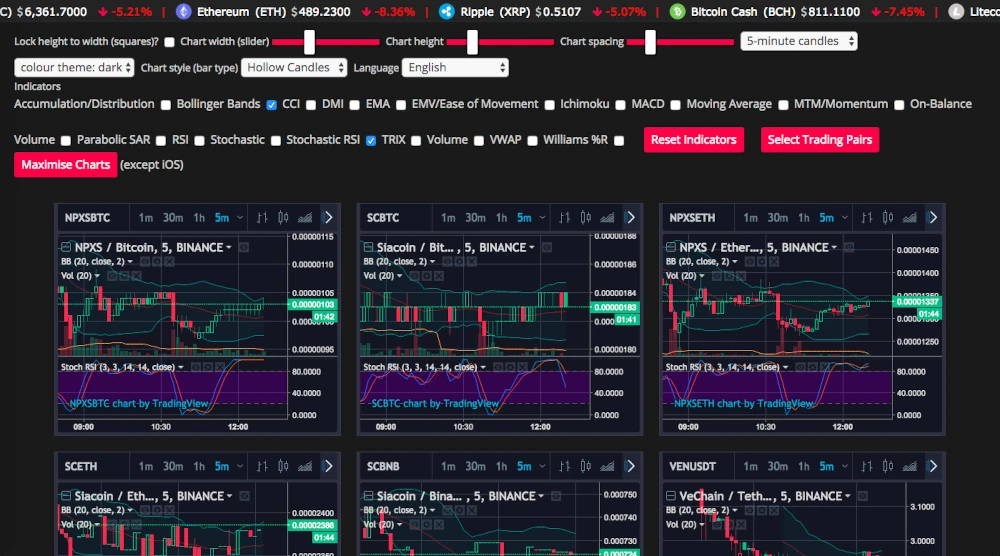

Technical Analysis Software for Traders

Technical analysis software has transformed my crypto day trading approach. I use TradingView to create detailed chart patterns and identify key support and resistance levels. The platform’s customizable indicators allow me to target entry and exit points with more accuracy. For my momentum tracking, I rely on CoinTrader. A pro that gives me the real-time price movements for the different exchanges. These are necessary tools for getting a good picture of the market trends that cannot be observed easily. Michael van de Poppe, the market expert, is quoted as saying, “A proper technical analysis software is not an option for a serious day trader – it is a necessity to find high probability set-ups.” My most profitable trades consistently come from opportunities spotted through these specialised tools rather than from random market monitoring.

Conclusion: Refining Your Crypto Selection Process

Day trading cryptocurrencies requires the selection process to be systematic. You have to select “hot” coins, not just follow the market hype. Through essentially a lifetime of trading, I know that being successful at day trading entails balancing three important things: liquidity so you can execute trades easily, volume for pricing determination, and relative volatility. My platform preferences include risk management capabilities. This can be measured through maximum allowable position sizing and stop-losses. I prefer to accompany all of this with indicators to capture valid entry and exit points. The specialised tools I’ve discussed provide the analytical edge needed in this fast-paced market.

Last, I want to emphasize that selecting a crypto is not just a one-off decision for the sake of example. It is a continuous decision-making process where refinement of decision-making will become relevant as the market conditions change. Apply these principles and be consistent with them. You will put yourself in an advantageous position to be able to identify trades that will put money in your pocket and limit the likelihood of complete capital loss in the relentlessly volatile and equally rewarding world of day trading cryptocurrencies.